Several actions were taken manually during the process and making the bank settlement reconciliation more complex, monotonous, and time-consuming tasks to handle.

Our Solution

Our RPA solution approach was ready to improve the customer's output, by automating and eliminating the time-consuming Bank Settlement reconciliation process.

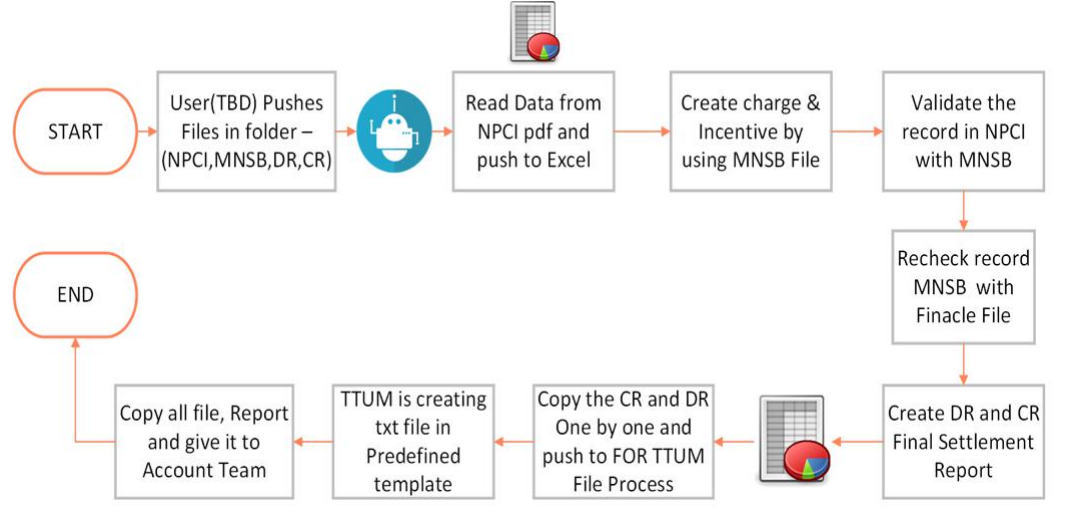

- RPA bot with its intelligence to read data from all the input files does require validation and checks on data as per the set business rule.

- Bot performs reconciliation of MNSB data with NPCI data and Finacle data.

- Bot generate the Final settlement Report and create a TTUM file and mail it to concerned stakeholders.

Automation Benefits

Deployed RPA bots get to automate the end-to-end process and brings forth several benefits

- Reduce operational cost by 75%

- Improved consistency and quality with a 0% error rate

- Improvement of Service levels from - 45min to 7 min

- Improved staff retention - By reducing high volume low-value work to shift the focus on complex/value-driven task

- Increase in scalability

- Bot running 24/7 increase the performance output rate of the process